Copper in a ‘materials trilemma’: McKinsey

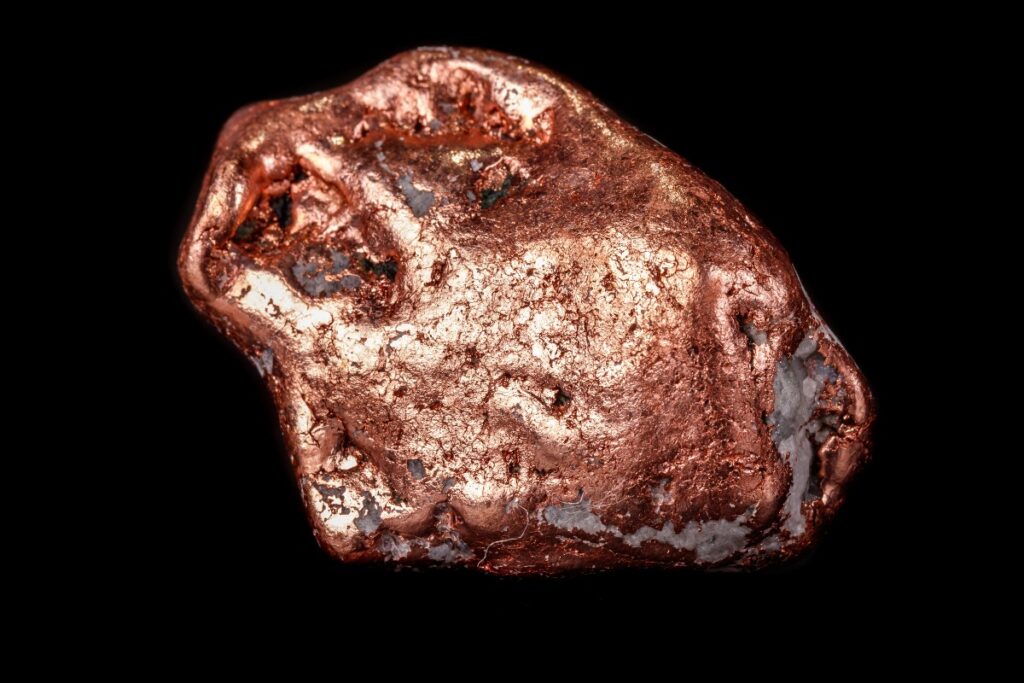

Copper is a key metal for the global energy transition but is grappling with supply challenges as it becomes entangled in what McKinsey & Company calls the “materials trilemma”.

At the launch of McKinsey’s first Global Materials Perspective, McKinsey senior partner Michel Von Hoey explained that mining companies are feeling the weight of these issues, particularly in copper production.

“We still project supply shortages across a number of critical materials if we take a 2035 horizon,” Von Hoey said from Luxembourg.

Copper is among those materials facing a supply deficit as global demand increases.

“Demand growth remains very high for some materials, and we still expect shortages, notably in copper, lithium, sulphur, and rare earths, of somewhere in the neighbourhood of 10-to-50 per cent of demand by 2035,” Von Hoey added.

Given its importance in electric vehicles and renewable energy technologies, copper is fuelling the energy transition. But the base metal is falling short of production targets.

McKinsey said that while the $4 trillion mining and metals industry has sufficient financing capacity to meet demand, actual capital deployment is contingent upon the availability of profitable and attractive projects.

The report estimated that $5.4 trillion of capital expenditure (capex) would be required by 2035 to match current demand outlooks.

McKinsey senior metals expert Patricia Bingoto said that copper mining and processing capex alone would amount to $780 billion between 2024 and 2035.

“We still anticipate shortages for several materials that are key to the energy transition compared to the demand expectations, in particular rare earth elements, lithium, sulphur, uranium, iridium, and copper,” Bingoto said.

Metals specialist Gustav Hedengren said there’s need to be more incentive for developers.

“For copper, an approximate 20 per cent increase from current prices will likely be required to incentivise sufficient supply to come online,” he said.

However, this price rise may not be enough to stimulate new projects in time to meet 2035 demand.

“The lead time of a normal copper project is already longer than the 11 years we have left until 2035, so it’s not very likely that you will have a massive announcement of supply over the next couple of years which will be online in 2035,” Hedengren said.