The London-based Baltic Exchange (Baltex) tracks the cost of moving commodities along more than 50 routes around the world and the BDI is considered one of the go-to barometers of the global economy, and a leading indicator of commodity prices.

In February 2016, the index dropped to the lowest level since 1985 when Baltex first started tracking the data. Like most hard commodities, the index has recovered nicely since then, sailing to a five-year high in August despite headwinds from the intensifying US-China trade war.

Daily rates for Capesizevessels now stand at a shade under $8,000. That`s down 70% since August

But that all changed this week with the BDI dropping over 10% since Monday with Bloomberg reporting a fall to just above 1,000 points "despite only modest expansion in fleet capacity, the usual culprit when rates collapse. This time, it’s about waning growth in Chinese demand."

Capsized

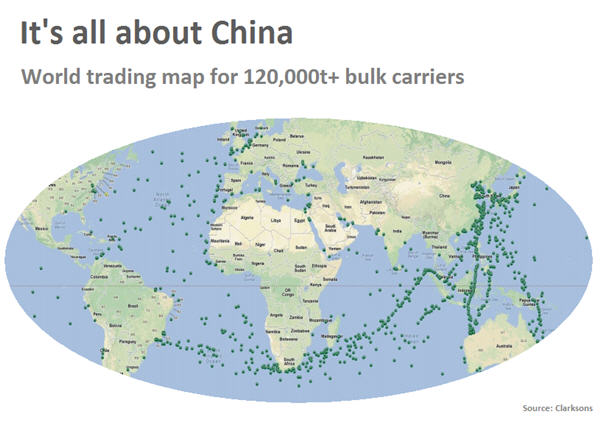

Of the freight rates tracked by the exchange, those for Capesize ships provide the best insight into the health of Chinese commodity demand. The surge in iron ore trade beginning a decade ago translated into a massive boost for daily earnings for Capesizes, the largest ships tracked by the index and so called because these vessels cannot use the Panama Canal.

Capesize rates topped out at an eye-watering $234,000 in June 2008 but has gone as low as just $4,015 a day. According to Bloomberg data, daily rates for Capesize vessels now stand at a shade under $8,000. That`s down 70% since August.

Capesize vessels can haul roughly 160,000–180,000 tonnes and are the dominant vessels for the world`s 1.4 billion tonnes of seaborne iron ore trade. The steelmaking ingredient represents more than a fifth of the global dry bulk trade and is the second most traded commodity after crude oil and ahead of coal.

Chinese steelmakers increasingly prefer high-quality imports from Brazil and Australia over domestic iron ore, but inbound cargoes fell to a four-month low of 88 million tonnes in October, despite heavy demand ahead of winter production curbs.

World number three producer BHP suspended all rail operations from its Pilbara mines in Western Australia after a runaway train incident this week. That hasn`t helped shipping companies, but is underpinning prices for iron ore.

Iron ore prices have stayed afloat this year with benchmark prices at the Chinese port of Qingdao of 62% Fe content ore at $74.93 per dry metric tonne, according to data supplied by Fastmarkets MB. That`s flat for the year.

Steelmaking coal (premium hard-coking coal FOB Australia) exchanged hands for $225.49 a tonne Thursday, down 13% since the start of the year. Thermal coal benchmark price stayed above $100 a tonne on Thursday, but is now down more than 11% for the fourth quarter.